Sounds too good to be true, right? But it’s actually possible with an IRA. So what is an IRA? It’s an investment account that allows you to save money for retirement. But really, it’s a magical place where your money lives, works and makes more money to support you in your old age.

If you contribute $5,500 to an IRA this year and then completely ignore it for the next 30 years, that $5,500 will turn into over $40,000 (based on historic rates of return). Yes, 30 years is a long time. But this example is based on just one contribution. Make that same contribution annually for only 10 years and you end up with over $80,000 (again based on historic rates of return) at the end of 10 years. You’ve just made nearly $30,000 without lifting a finger! Unlimited juice!

Ready to get started? You’ll need to understand a few details first.

1. Tax Rates

There are two types of IRAs. Which one you choose to invest in should be based on whether you anticipate having a higher or lower tax rate during retirement than you have right now.

If your tax rate will be lower in the future, consider contributing to a traditional IRA. Traditional IRAs allow you to deduct your contribution amount from your taxes. For example, if your income was $50,000 last year and you contributed $5,000 to a traditional IRA, you would only be taxed on an income of $45,000. However, you will then be taxed on the money you withdraw from your IRA during retirement.

If your tax rate will be higher in the future, consider contributing to a Roth IRA. They work in reverse. You pay taxes on your contributions, but your withdrawals are tax-free.

High taxes now, low taxes in the future = Traditional IRA

Low taxes now, high taxes in the future = Roth IRA

Have no idea what your future tax rate will be? You can always hedge your bets and contribute to both. Just make sure your total contributions don’t exceed the contribution limits. Yes, there are limits. The IRS loves setting limits.

2. Contribution Limits

For 2018, the IRA contribution limit is $5,500 per year. You can contribute an additional $1,000 per year if you’re over age 50, for a total of $6,500 per year. Whether you contribute the full amount to one type of IRA or split it between both, you are not allowed to contribute more than $5,500 (or $6,500 if you’re over 50) in total.

Sounds easy enough. But wait. There are more limits.

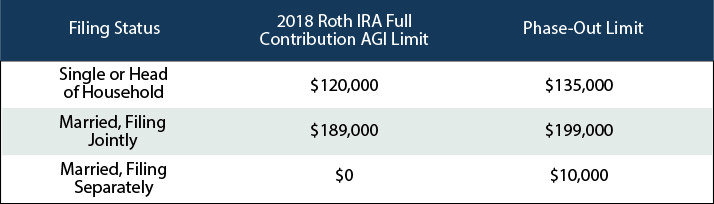

3. Income Limits for Roth IRAs

If you make too much money (tough problem to have, right?), you may not be eligible to contribute the full $5,500 to a Roth IRA. Here’s a handy dandy chart to illustrate the limits:

You can contribute the maximum amount only if your adjusted gross income (AGI) is less than the full contribution limit. You only get a partial contribution if your AGI is between the two limits. If your AGI is greater than the phase-out limit, no soup for you! You don’t get to contribute at all.

4. Income Limits for Traditional IRAs

You can contribute the max to a Traditional IRA no matter what your income is. But you can only deduct your contribution if your income is below a certain amount.

If BOTH you and your spouse have no retirement plan through your employer, you can deduct the entire contribution amount from your taxes. However, if either of you have a retirement plan through your employer (401k, pension, etc.), your ability to take a deduction is income-restricted.

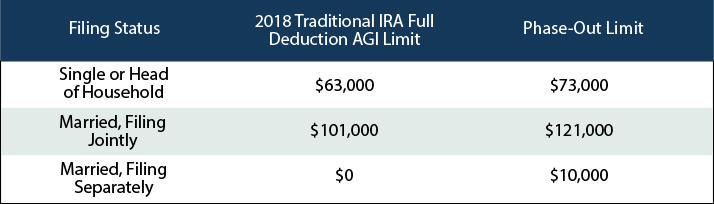

If YOU participate in an employer’s plan:

Just like the Roth IRA chart, you can deduct your entire contribution only if your adjusted gross income (AGI) is less than the full deduction limit. If your income falls in between the two, you get a partial deduction. And if your income is above the limit, you get no deduction.

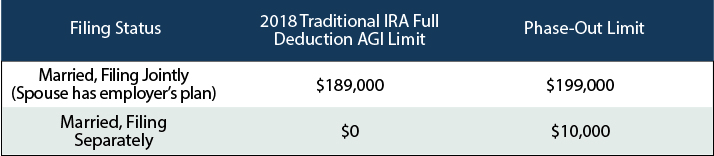

If you don’t participate in an employer’s plan, but your SPOUSE does, you get a different chart:

Example: You contribute $5,500 to an IRA. Your spouse has an employer-sponsored retirement plan, but you don’t. You file your taxes jointly and your total income between the two of you is $125,000. You can deduct your entire $5,500 contribution. This means you pay taxes on only $119,500.

Example 2: Same as above, but you have an employer-sponsored plan. You get no deduction. Sad face.

5. Income

One more restriction. You can only contribute to a 2018 IRA if you earned income in 2018. This includes salaries, wages, tips, bonuses and business income, but not investment income. So if you worked part-time and earned $4,000 this year, you can only contribute $4,000 to an IRA.

6. Timing

Another magical thing about IRAs is that you can contribute to last year’s IRA up until the tax deadline this year. That’s right, you have until April 17, 2018 to contribute to your 2017 IRA. So what are you waiting for?

Be sure to follow us on social media for more magical money growing tips.